maine excise tax refund

The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Maine Revenue Services temporarily limits public access PDF Maine Revenue Services Announces Limited Telephone Tax Payer.

. Refund information is updated Tuesday and Friday nights. Please enter the primary Social Security number of the return. Fuel exempt from Maine excise tax becomes subject to Maine salesuse tax.

The rates drop back on January 1st of each year. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Any change to your refund information will show the following day. Marijuana Excise Tax Tax payments for these tax types can be made now via the Maine Tax Portal MTP at.

If a motor fuel is sold without excise tax the receipt. While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on goods are generally non. June 2021 Department of the Treasury Internal Revenue Service Check here if.

Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund. The purchase price of gasoline and clear diesel generally includes excise tax. Tax Return Forms NOTE.

Refund Programs Aeronautical Aeronautical Refund Request Form Vendor Form First time filers must complete Vendor Form Vendor Form Instructions Note. FAQ about Coronavirus COVID-19 - Updated 472021. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Excise tax is an annual tax that must be paid prior to registering your vehicle. How do I know if I paid Maine excise tax on my fuel.

Requests for a refund. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person. The bureau shall refund all excise tax paid by the wholesale licensee or certificate of approval holder on all malt liquor or wine caused to be destroyed by a supplier as long as the quantity.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Can I get a Maine Excise Tax Refund. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns.

Welcome to Maine Revenue Services EZ Pay. GTR-PS Fuel Tax More Fillable Forms Register and Subscribe Now. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

YEAR 1 0240 mill rate YEAR 2 0175 mill rate YEAR 3. Sales Use. The purpose of the tax is to partially offset the costs of forest fire.

Excise tax paid on gasoline purchased in Maine and used for commercial purposes other than the operation of a registered vehicle on the highways of Maine may be eligible for a refund. A refund of excise tax may be available to government agencies for purchases of gasoline or. Withholding and Unemployment Contributions 941ME and ME UC-1.

Cummings Lamont Mcnamee Cpa Firm Accounting Firm In Maine And Nh

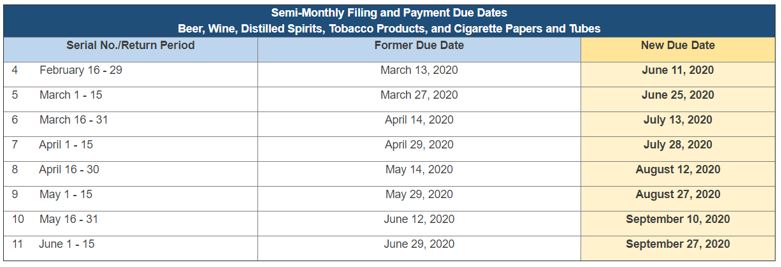

Due Dates For Taxes And Operational Reports Postponed For Breweries

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Rising Gas Prices Excise Tax Refund Offers Relief Tip Excise Tax Recovery Services

3 10 72 Receiving Extracting And Sorting Internal Revenue Service